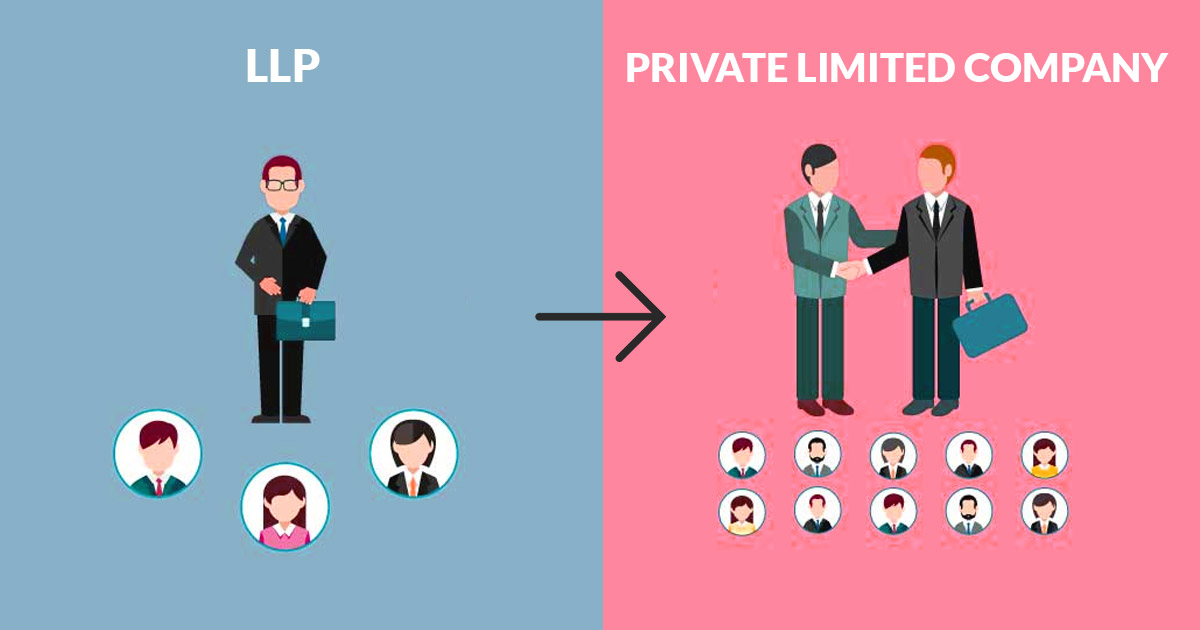

Easy Guide To Convert Llp Into Private Limited Company

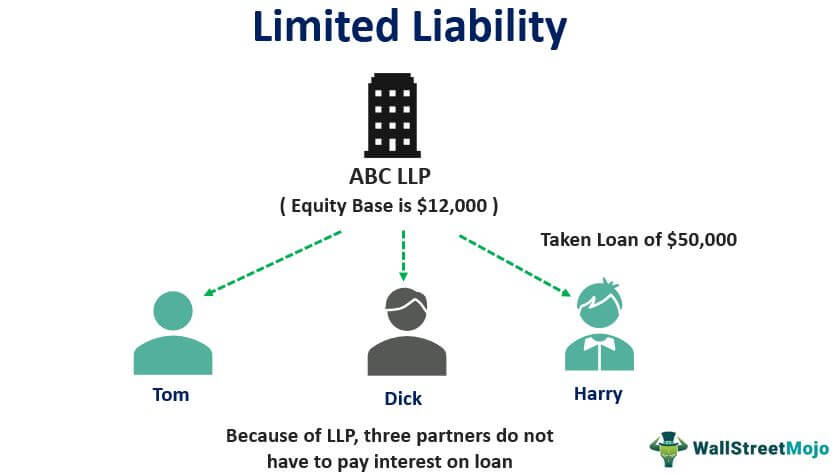

D LLCs cannot be dissolved unless the owner of the LLC dies E In an LLC, only the government can dictate when the company can be dissolvedBarcelona chief executive Ferran Reverter has said the club would have been "dissolved" in April if it was a public limited company (PLC) after being taken to the brink of bankruptcy by the previous board Reverter branded former president Josep Maria Bartomeu's running of the club as "disastrous," accusing him and his directors of signing players they could not afford, offering

A public limited company could be dissolved when

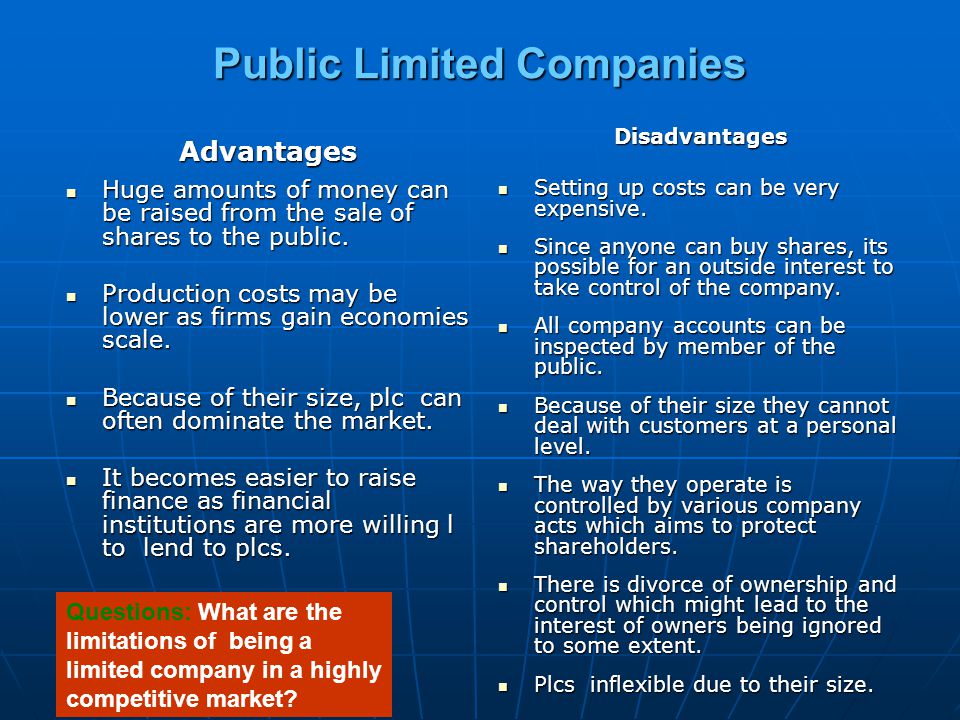

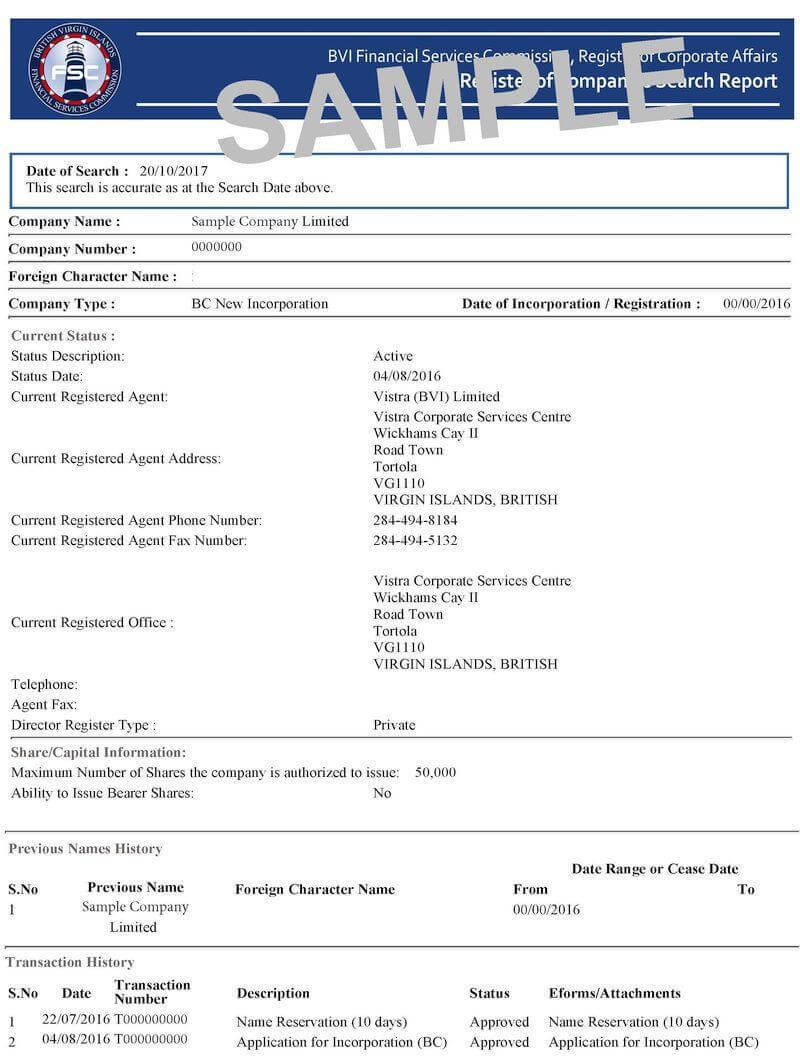

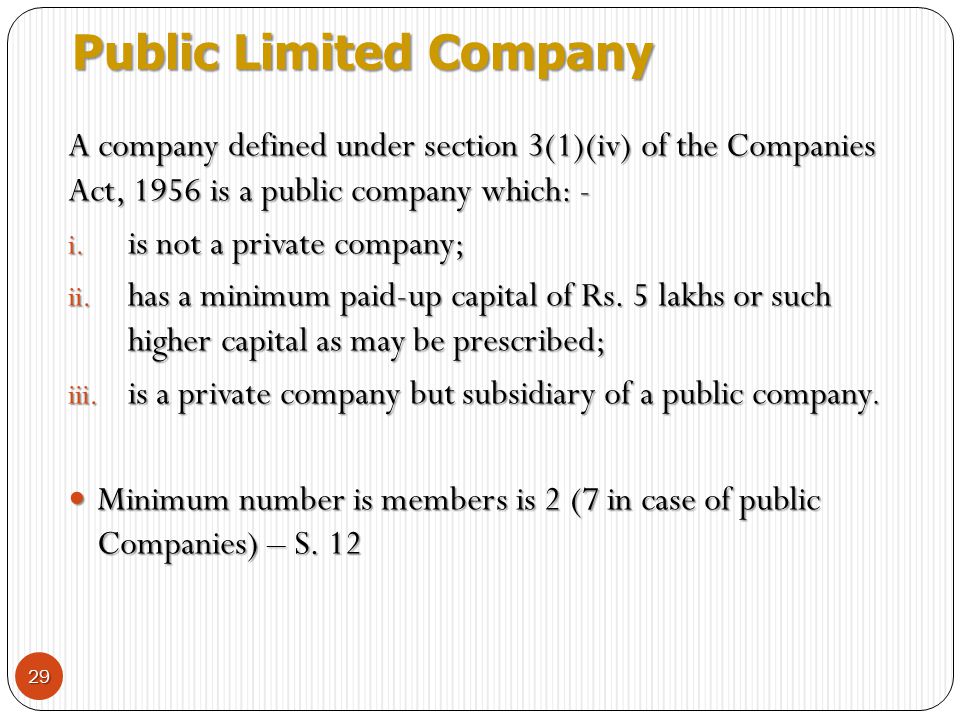

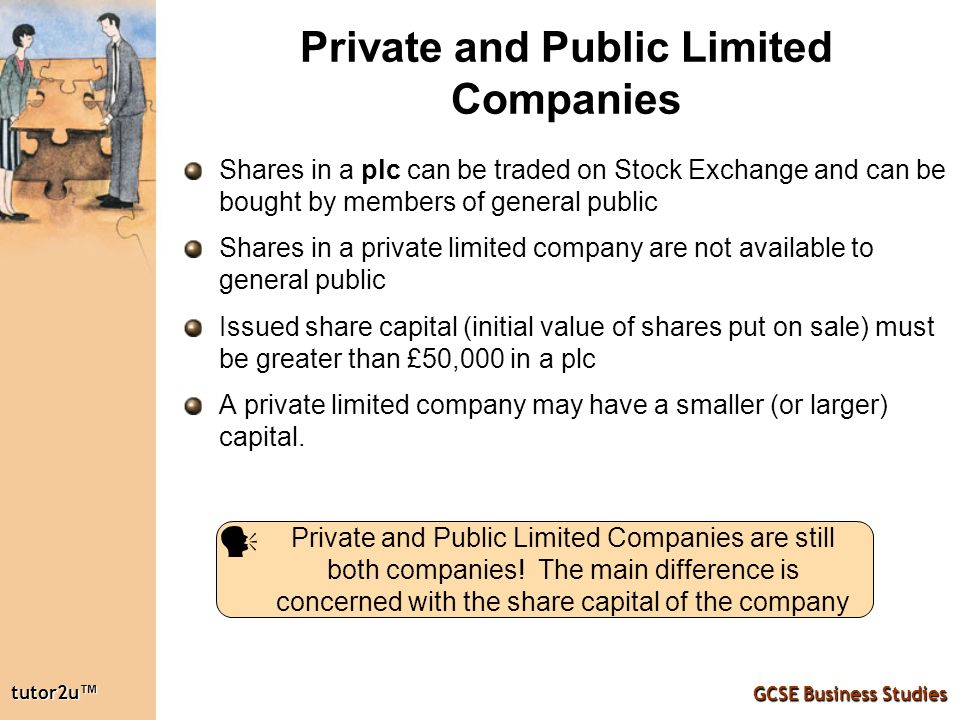

A public limited company could be dissolved when-If the investigation finds any acts of wrongful trading, fraudulent trading or misfeasance during your time in office, you could find yourself on the receiving end of one or more severe penalties These include Disqualification as a director for a period up to7 The name of a public limited company must end with the words "public limited company" or the abbreviation "plc"5 A public limited company is required to have a company secretary A public limited company is one whose shares are traded, as opposed to the simple limited company whose shares cannot be so transferred 8

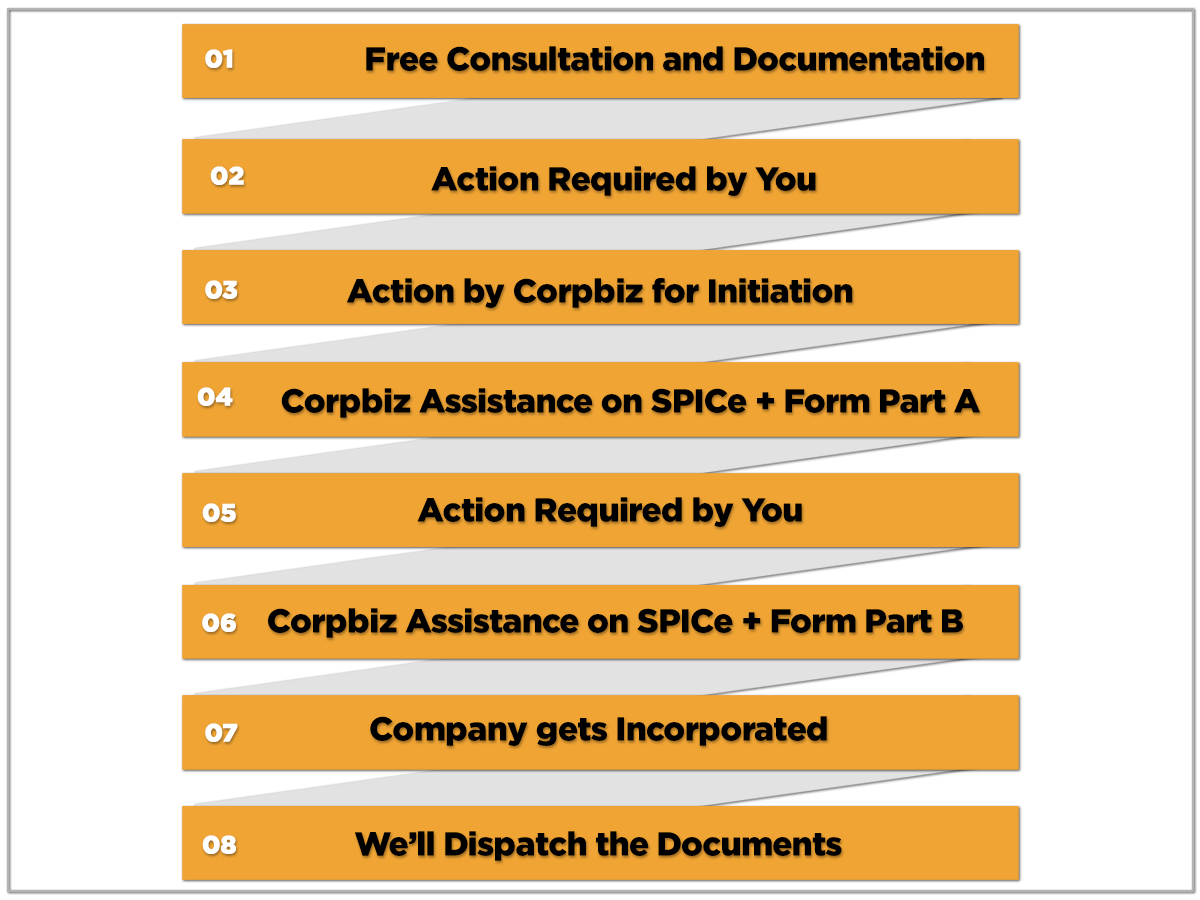

Online Company Registration Register Your Private Limited Company Corpbiz

The process is known as ' Administrative Restoration ', and it can only be initiated by a former director of the company or by a former shareholder Furthermore, the company can only be reinstated if it was only dissolved within the last six years Longer than six years and the process can't be startedJR CONSTRUCTION (UK) LIMITED was founded on and had its registered office in Basildon The company was dissolved on the and is no longer trading or activeThe law of escheat The shareholders or creditors of a dissolved company cannot be regarded as its heirs and successors On dissolution of a company, its properties, if any, vest in the government

Company dissolution is when a business and all of its information is removed from the Companies House public register Unfortunately, more and more companies have to go through this process each year, this can be due to many reasons such as;The Companies Act 06 set out that any company assets remaining on dissolution, will pass to the Crown The Crown then appoints an Official Receiver who gets on with the business of distributing the company's assets to anyone the company owes money to, or otherwise, the Crown simply keeps the assets This includes the company bank balance! Barcelona chief executive Ferran Reverter has said the club would have been "dissolved" in April if it was a public limited company (PLC) after being taken to the brink of bankruptcy by the previous board Reverter branded former president Josep Maria Bartomeu's running of the club as "disastrous," accusing him and his directors of signing

A public limited company could be dissolved whenのギャラリー

各画像をクリックすると、ダウンロードまたは拡大表示できます

|  |  |

|  |  |

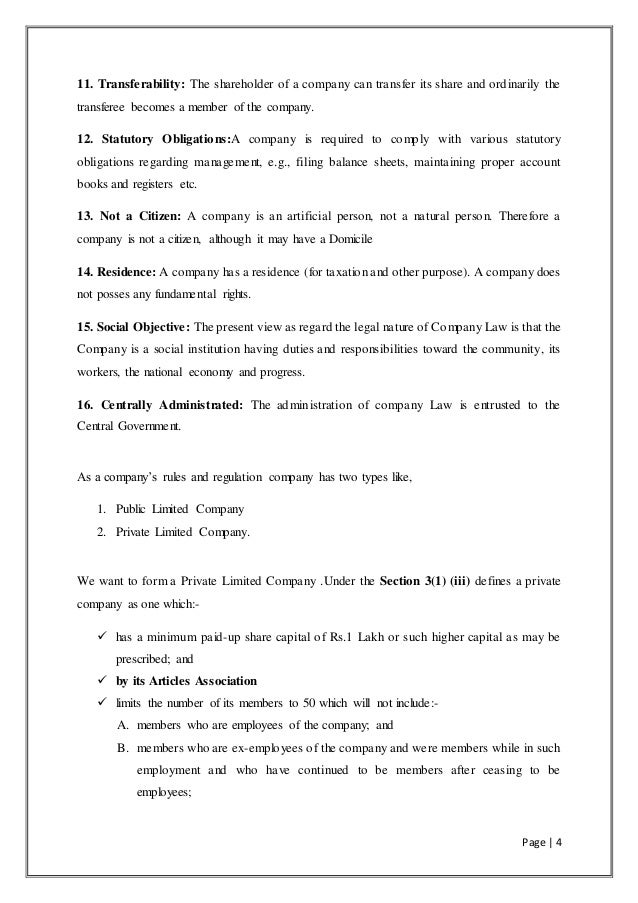

|  |  |

「A public limited company could be dissolved when」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

|  |  |

「A public limited company could be dissolved when」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

|  |  |

「A public limited company could be dissolved when」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | /limited-liability-company-on-the-sticky-notes-with-bokeh-background-1158519140-44f25af400984f9a9433816c92076223.jpg) |

|  |  |

|  |  |

「A public limited company could be dissolved when」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  |  |

|  | |

「A public limited company could be dissolved when」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |  |

|  | |

「A public limited company could be dissolved when」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  | |

|  |  |

「A public limited company could be dissolved when」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

|  |  |

「A public limited company could be dissolved when」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

| /limited-liability-company-on-the-sticky-notes-with-bokeh-background-1158519140-44f25af400984f9a9433816c92076223.jpg) |  |

|  |  |

「A public limited company could be dissolved when」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  | |

|  |  |

「A public limited company could be dissolved when」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |  |

|  | |

「A public limited company could be dissolved when」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  |

Moises Llorens Barcelona chief executive Ferran Reverter has said the club would have been "dissolved" in April if it was a public limitedAn HMRC enquiry into a limited company can be launched after it has been dissolved, but there are specific time limits If your accounts and personal tax computations were filed within the correct time limits, HMRC has up to six years from the end of the tax year concerned to issue a 'discovery assessment' in cases of carelessness

0 件のコメント:

コメントを投稿